Policy Center for the New South

Seeking Alpha, TheStreet.com, Affluent Society, Capital Finance International

The start of 2022 has been marked by simultaneous signs of a slowdown in global economic growth, and a reorientation toward tightening of monetary policies in advanced economies. In its Global Economic Prospects report, published on January 11, the World Bank forecast that, after a rate of global growth at 5.5% last year, it should moderate to somewhere around 4.1% in 2022 and 3.2% in 2023.

In addition to the effects of the Omicron COVID-19 variant at the start of 2022, less fiscal support and lingering supply chain disruptions and bottlenecks point to a slowdown. In the United States, business and consumer confidence surveys in December already suggested a landing in progress.

For China, the World Bank, expects GDP growth of 5.1% this year, below the 8% estimated for 2021. In addition to possible restrictions on mobility because of China’s ‘zero COVID’ approach, the adjustment in the property sector will contain consumer spending and residential investment.

While advanced economies and China reduce their paces of expansion, central banks are on a tightening path—apart from in China. The Federal Open Market Committee (FOMC) of the Federal Reserve Bank (Fed) of the United States meets on 25-26 January. But the reorientation of its monetary policy since October has been clear in the minutes of its meetings since then, and in statements by its president Jerome Powell. In addition to a U.S. unemployment rate below 4%, consumer price inflation ended the year at 7%, a level not seen since the early 1980s. Treating it as a ‘transitory’ phenomenon has been abandoned by the Fed.

While the September 2021 FOMC meeting suggested an interest rate hike this year, the stakes are now three or four increases. In addition, the end of the Fed’s bond-buying program was brought forward to March, while Jerome Powell telegraphed that the Fed’s balance sheet reduction would begin sooner than expected, perhaps as early as mid-year.

After interest rate hikes in the United Kingdom, Norway, and New Zealand, the same is expected in Canada later this month. Moves in the same direction by the European Central Bank and Sweden are now anticipated for early 2023.

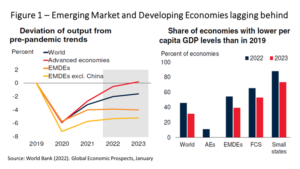

This is the external scenario faced by emerging and developing economies, whose slow recovery from the pandemic is expected to continue. The World Bank does not expect their return to pre-pandemic GDP and investment trends in 2022-23 (Figure 1).

High inflation rates and public indebtedness during the pandemic are constraining the adoption of expansive fiscal and monetary policies in emerging and developing countries. Not coincidentally, higher interest rates and the downward revision of fiscal support are seen in most cases. The question is whether the growth slowdown with tightening financial conditions in advanced economies is likely to be disastrous for emerging markets, with landing becoming a hard one in their case.

Tightening external financial conditions will doubtlessly accentuate the challenges facing emerging market policymakers. For emerging market economies that are currently undergoing significant domestic inflationary pressures, the risk of additional pass-through pressures from currency depreciations after markets embed higher U.S. interest rates will be key in setting monetary policy. In this case, while monetary policy tightening cycles began in 2021 in Brazil, Mexico, and Russia, following inflation rates moving above their targets, central banks in India and Indonesia maintained an accommodative stance, given low domestic core-inflation rates.

Pro-cyclicality of capital flows would also be a factor impacting those countries. Emerging market economies with a high share of foreign participation in domestic capital markets and more open financial sectors are vulnerable to the volatility of such flows. Central banks in these countries may be forced to tighten monetary policy beyond what would be adequate from a growth perspective. South Africa and Mexico are such potential cases. In cases of financial markets largely domestically funded—as it is currently in India, Brazil, and Malaysia—the vulnerability to capital outflows driving substantial currency depreciation is lower.

However, the answer to the question about the nature of the landing facing emerging market economies will ultimately depend on how aggressively the monetary policy reorientation in advanced economies takes place. If inflation moderates in the United States, due to reduced fiscal stimulus and fading supply chain restrictions, while growth remains minimally robust, emerging markets could avoid a hard landing. Several factors favor such a scenario.

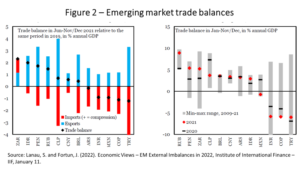

First, there has not been a large inflow of foreign capital into emerging market economies in the recent past. Jonathan Fortun, in the Institute of International Finance’s (IIF) January 10 Capital Flows Tracker, suggested that there has already been a “sudden stop” in such flows, albeit with great differentiation among emerging markets. One may expect that there would be no external resources to flee massively in the event of a gradual rise in external interest rates.

Sergi Lanau and Jonathan Fortun, from the IIF, also highlighted that emerging-market current account deficits have been remarkably low or nil in the last two years. Figure 2 illustrates that by displaying trade imbalances. In the case of Latin America, foreign reserves increased in 2021, following the reinforcement of liquidity buffers started in the second half of 2020, in addition to the increase in Special Drawing Rights (SDRs) approved by the IMF in the middle of last year.

What about exchange rates? Are they at levels of overvaluation that make them vulnerable to sudden and catastrophic devaluations? Here Robin Brooks, Jonathan Fortun, and Jack Pingle, from the IIF, suggest a more heterogeneous picture: although most emerging currencies have experienced real devaluation in the last ten years, there is huge differentiation, with some now exhibiting sharp devaluation and others overvaluation.

In the case of Brazil, for example, they estimate a degree of around 20% of excess devaluation of its local currency below what would be expected from its fundamentals, such as current account balances and stocks of foreign assets and liabilities. The non-return of the exchange rate to pre-pandemic levels contributed to Brazilian inflation ending 2021 in double digits—on top of food and energy shocks. In any case, in Brazil and other emerging countries without exchange overvaluation, a high probability of dramatic exchange rate adjustments is not foreseen … provided that, in turn, the reorientation of monetary policy in advanced countries also does not take on dramatic contours.

Thus, we maintain the scenario suggested last July. Except in the case of drastic monetary adjustments in advanced economies, one must focus on domestic factors to understand the weaker performance of emerging markets in the immediate future, as depicted in Figure 1.

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.