Policy Center for the New South, PB – 51/24

Otaviano Canuto and Antônio Jorge Martins

Also at Seeking Alpha and TheStreet.com

The road to decarbonizing the planet runs through the energy transition, which includes the shift from fossil-fueled cars to renewable energy vehicles (Canuto, 2021). This automotive transition is unfolding as a true revolution in the industry.

Since the nineteenth century, the automotive sector has undergone profound transformations, initially driven by European, American, Japanese, and later, Korean giants. These traditional automakers played a fundamental role in global automotive industrialization, shaping the market’s evolution throughout the twentieth century.

The evolution toward mass take-up of electric and hybrid vehicles has come in tandem with the ascent of Chinese producers. In the current context of geopolitical and technological rivalries, the automotive transition has been marked by an intense trade war, with implications for the trajectory of decarbonization.

The Rise and Maturing of the Automotive Industry

From the emergence of small family-owned businesses at the end of the nineteenth and early twentieth centuries, to the evolution of some of them into global giants, the automotive sector has undergone several phases of transformation. A major milestone for the automotive industry occurred in 1886 with Germany’s development of internal combustion engines. Until the 1990s, American, European, Japanese, and Korean companies were primarily responsible for the evolution seen in the sector, but their dominance waned after 2003 because of the revolution led by Tesla with electric vehicles (EVs) and autonomous driving, as well as China’s emergence in 2010 as a key player in the global automotive industry. China offers low-cost, high-tech production, making it the largest automotive market in the world, with local brands gaining global prominence.

The introduction of the assembly line in 1913 by Henry Ford revolutionized the vehicle industry, making cars accessible to a wider public. In the twentieth century, the exponential growth of the automotive industry across all continents, especially after the Second World War, saw the rise of automakers including Ford, VW, Mercedes-Benz, Renault, Fiat, Peugeot, and Citroën. This growth was driven by the strategic acquisition of small companies focused on niche markets, and by optimizing industrial operations, leading to greater participation in the global market. Partnerships and alliances played a crucial role in advancing technologies and standardizing processes, further accelerating the sector’s development.

In the second half of the twentieth century, Japan strengthened its position in the automotive sector, with its automakers becoming global benchmarks for quality and efficiency through the creation of new industrial processes. In the 1990s, Korea emerged as a global competitor, with its automakers gaining prominence in Western and emerging markets, establishing themselves as global players.

Brazil in the 1970s developed the National Alcohol Program (Proálcool), aiming to promote the use of ethanol (alcohol) as an alternative fuel to gasoline in order to reduce dependency on oil imports. The use of biofuels—combined with fossil fuels—has been a special feature of the country (Canuto, 2007).

Tesla, China and the Emergence of a New Disruptive Phase

In the early twenty-first century, however, a new disruptive phase began to take shape. Tesla began to play a significant role in the sector, not only popularizing EVs but also, through autonomous driving technology, becoming a symbol of innovation and sustainability in the automotive industry. Some American companies have sought to adopt Tesla’s model of products and services, but have failed to achieve the same success. Complacency accompanying the dominance of combustion engine vehicles left Western automakers unprepared for the rise of EVs, forcing them now to rethink their strategies.

The emergence of EVs and hybrid cars, as well as the rise of Chinese automakers challenged the dominance of traditional manufacturers. Companies such as Tesla, with its autonomous cars, and Chinese automakers, such as BYD, began to dominate the sector by introducing electric and hybrid vehicles with advanced technology and competitive prices. This new landscape caught Western automotive industries off guard, as they were accustomed to the continuous success of combustion engines.

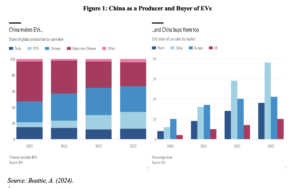

As the world’s largest automotive market and a major export hub for all continents, China emerged as a leader in the EV market, including both fully electric and hybrid vehicles, with its companies supplying the global market with highly technological vehicles at prices lower than their competitors (Figure 1).  Source: Beattie, A. (2024).

Source: Beattie, A. (2024).

The success of Chinese manufacturers began in 2001 when the automotive sector was designated a ‘Priority Scientific Research Project’ under China’s Five-Year Development Plan. The project gained significant momentum in 2007 when the Chinese government decided that development efforts should focus on ‘electric motorization’ rather than improving combustion engines, allocating substantial human and financial resources to research and development of the project.

It is important to note that, to meet this strategic objective of electric motorization for Chinese companies, there were no limits set on the number of interested parties or specific policies towards existing companies or startups. As a result, over 100 newcomers emerged, though many eventually exited or went bankrupt. This led to the rise of numerous Chinese EV manufacturers, with notable players including BYD, GWM, NIO, Xpeng, Geely, and SAIC Motor. A parallel can be made with the way in which South Korea’s conglomerates developed as a result of a Schumpeterian ‘creative destruction’ process, with both winners and losers along the way (Canuto, 2020).

To enter the vast Chinese market, Western companies were forced to form joint ventures with local partners, facilitating the absorption of automotive technology by local groups, many of whose shareholders had academic and professional backgrounds from the U.S. Additionally, the rise of automotive startups, many backed by tech groups, accelerated innovation and the evolution of the EV and hybrid markets.

An exception to the joint venture rule was Tesla, which received approval to build its own factory in Shanghai (Gigafactory 3), the company’s first unit outside the United States, which started operations in 2019. By not following the traditional model, Tesla formed strategic partnerships and collaborations with Chinese groups, including local supply agreements with CATL and LG Chem (LG Energy Solution). The combination of LG Chem and CATL batteries helps Tesla optimize costs and diversify and export its vehicle lineup to reach a broader audience.

Tesla’s operational model allowed greater control over its operations and rapid scalability in the Chinese market, continuing to be a key player in Tesla’s global operations today.

It is worth noting that foreign manufacturers dominated China’s automotive market starting in 1984, with VW selling millions of vehicles and achieving significant profits. However, this dominance ended with the meteoric rise of local brands in both the domestic and international markets.

For a holistic retrospective of China’s automotive sector:

- Foreign automakers’ market share of car sales fell from 53% in July 2022 to 33% in the same month of 2024 (data from CPCA-ANFAVEA China), while Chinese brands increased from 47% to 67%.

- VW lost its position as the best-selling car brand in China to BYD in 2023, a title it had held since 2000.

- The joint ventures of GM and Toyota in China reported significant losses at the end of the first half of 2024, with GM’s sales dropping from a peak of over 4 million in 2017 to 2.1 million last year.

- Honda, Hyundai, and Ford also took drastic measures, including layoffs and factory closures, to cut costs as local consumers increasingly favored Chinese brands over foreign ones.

- Meanwhile, BYD sold a record 3.02 million vehicles globally in 2023, including EVs and hybrids, marking a 62% increase compared to 2022.

In recent years, the rise of Chinese brands has been meteoric. In addition to dominating the domestic market, Chinese manufacturers have expanded their global presence, exporting vehicles to all continents.

The Automotive Transition, Competition, and Trade Wars

The rise of electric and hybrid vehicles is a clear global trend in the automotive sector today. China, in particular, has stood out in both the production and export of these vehicles. The Chinese domestic market continues to grow, driven by favorable government policies and increasing demand for sustainable mobility solutions.

Even with the world’s largest market located in China, exports have risen thanks to government incentives and the large number of local producers, which has resulted in a significant price war. To shift their focus to new markets and reduce pressure to lower prices, numerous manufacturers have turned to foreign markets.

Like BYD, Tesla operates on all continents, focusing on luxury electric vehicles, autonomous driving systems, charging infrastructure, and solar panels. China’s global exports of EVs grew by 70% from 2022 to 2023.

This Chinese expansion has fueled a price war in the EV market. With so many manufacturers competing, many turned their efforts to external markets, seeking relief from the limits of local demand growth and the corresponding deflationary pressure. In this scenario, BYD and Tesla responded differently to the intense competition. While BYD diversified its global operations, Tesla focused on autonomous driving systems, such as Autopilot and Full Self-Driving (FSD), creating technological differentiators that have freed it from purely price-based competition.

A critical point for the success of EVs is the charging infrastructure, which remains underdeveloped in many markets. Hybrid vehicles attempt to strike a balance, offering some energy efficiency without the logistical challenges of fully electric vehicles.

Chinese competitiveness, driven by government support, has put Western automakers under intense pressure. For many European and American manufacturers, competing with Chinese brands has become a daunting task, especially because of the support Chinese companies receive in terms of innovation and research and development (R&D). In response, some of these automakers are forming strategic alliances with Chinese manufacturers, aiming to strengthen the development of electric vehicles and expand their presence in European and Latin American markets, though with limited success.

The global vehicle sales landscape in 2023 returned to pre-pandemic levels, with 65 million units sold. However, the market is more fragmented than ever, with the rise of new startups, particularly Chinese ones, seeking to establish themselves globally. For traditional automakers, this new environment demands rapid adaptation. Survival and success are directly tied to the ability to innovate, enabling greater competitiveness in a market that values cutting-edge technology and energy efficiency above all else.

The sharp depreciation of fully electric vehicles (EVs), which has caused resale difficulties—either because of the arrival of newer, cheaper models, or concerns about the high cost of battery replacement and the lack of charging stations—has led hybrid vehicles to gain a prominent position among consumers, achieving greater market penetration worldwide.

The threat posed by Chinese brands to century-old automotive industries has triggered tariffs in Europe, North America, and Brazil, on electric vehicles imported from China. In the U.S., tariffs on EVs from China will quadruple, from 25% to 100% this year. There are currently very few EVs from China in the U.S., but the Biden Administration and U.S. automakers worry that low-priced, heavily subsidized EVs could soon flood the U.S. market.

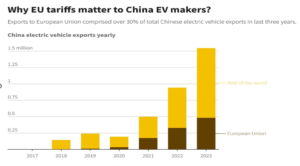

European Union member states have in turn agreed to establish tariffs of up to 45% on imports of Chinese EVs, though support for this was not unanimous, with a number of countries, including Germany and Hungary, voting against the tariffs, or abstaining (Bounds et al, 2024). Figure 2 illustrates why this matters substantially from China’s perspective.

Figure 2:

In Europe, there are even threats of factory closures, which could have significant impacts on employment in certain regions. It has become impractical for European automakers, still lacking abundant electric vehicle technology, to compete with lower-cost Asian companies, which are driven to increase their competitiveness by fierce domestic competition and government support for innovation and R&D.

Some century-old automakers face challenges stemming from shareholder agreements, with uncertainties around successors, and priorities given to stakeholders over the core business. Additionally, they grapple with high fixed labor and energy costs, which are incompatible with the current global manufacturing environment, driven by robotics, automation, and high production volumes. The share prices and expected profit margins of European carmakers have reflected this state of play (Figure 3).

Figure 3:

Source: Inagaki, K. (2024).

It is important to note that the intensifying EV competition in China, driven by numerous manufacturers and startups, has both local and global consequences:

- Chinese EV manufacturers focus on offering hybrids because of high prices and inadequate support for charging stations.

- Smaller Chinese rivals face financial difficulties or are eliminated because of the abundance of manufacturers.

- European automakers have scaled back their electrification ambitions because of new EV market conditions, focusing instead on developing hybrids to compete with Chinese brands.

- BYD’s scale and vertical integration support its profitability, providing greater flexibility in pricing and making it harder for other competitors—Chinese, Japanese, Korean, or European—to penetrate the market.

- BYD plans to increase its international sales from 12% to around 50% in the coming years, signaling continued fierce competition.

Currently, only a few automotive groups, such as Tesla and BYD, are recording exceptional profits, despite recent price reductions in vehicles. Tesla recently shifted its strategy, focusing on strengthening its Autopilot system already used in its cars and its Full Self-Driving (FSD) system, to escape the intense price competition plaguing the EV market. The previous strategy of producing high-demand vehicles at lower prices proved less effective in the current phase, as these vehicles are more sensitive to price volatility. There’s no denying that Tesla’s valuation is higher than any other automotive company because of the value it has created through its strong reputation as a sustainable, innovative company—first by launching EVs and now with FSD, supported by data from Baidu, China’s leading company in robotaxis.

Beyond electrification, vehicle automation and robotics are also becoming critical factors. The concept of vehicles acting as ‘smartphones on wheels’, equipped with advanced technology, is reshaping the driving experience.

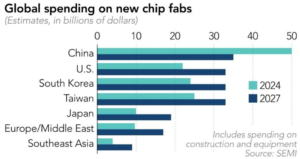

Semiconductors are becoming the new oil of the automotive industry, with China already prioritizing this sector. In 2024, the country invested $25 billion in semiconductor manufacturing equipment, with plans to double that amount by the end of the year. These investments are crucial for the development of more autonomous and energy-efficient vehicles. The United States is leading the competitive race for semiconductors, while China aims to maintain its edge in clean energy, including EVs.

The automotive transition is already being impacted by the geopolitical rivalry between the United States, Europe, and China. As well as the tariffs imposed by the U.S. and Europe on Chinese EVs, the Biden Administration has alluded to a potential ban on Chinese-made electronic components in vehicles operating in the U.S. because of ‘national security’ concerns.

Whither the Automotive Industry?

Hybrid vehicles still offer certain short-term advantages because of their lower cost and concerns about the availability of charging stations in some areas. However, stricter regulations on vehicles with gasoline engines will be implemented gradually (e.g. with key changes in California and the European Union starting in 2035).

In 2024, Chinese automakers are gaining ground in the global market, with BYD aiming to sell 4.0 million vehicles, placing it on par with Ford, which ranked sixth in 2023 with 4.4 million vehicles sold. On the other hand, despite the growth of China’s exports in 2023, Japanese, European, and Korean brands still maintain their leadership and top positions in the global market.

In an effort to reverse declining sales in China, Volkswagen acquired a 5% stake in Xpeng, aiming for a strategic partnership to jointly develop electric vehicles (EVs). Stellantis acquired a 20% stake in the international subsidiary of the Chinese EV manufacturer Leapmotor, with plans to begin selling these vehicles in several European and Latin American countries in 2024.

In addition to the urgent need to launch hybrid vehicles to counter the current global influx of Chinese EVs, the concerns of other automakers operating in this market will remain focused on increasing their competitiveness in the face of fierce competition. Along with technological advancements and the practice of reduced pricing, global manufacturers will continue to reinforce their investments in solid-state batteries to reduce costs, increase durability, and reduce the need for frequent recharging.

Although the rich economies are jointly lifting trade barriers against competition from China, in practice the tactics are slightly different. Some European firms are willing to integrate with the Chinese industry, while the Americans are pursuing a decoupling (Beattie, 2024).

As vehicles increasingly become ‘smartphones on wheels’, and considering the growing amount of integrated technology, semiconductors are becoming critical for essential systems including control, management, energy efficiency, and autonomous driving.

Semiconductor manufacturers in developed countries are making notable progress in advancing their products, including the integration of artificial intelligence. Last year, China spent a record $25 billion on chip-making equipment, surpassing South Korea, Taiwan, and the U.S. combined, according to the global chip industry association. The growing annual relevance of AI in semiconductors aimed at the digitization of products, services, and processes is evident from projected high spending on equipment through 2027 (Figure 4).

Beijing’s record investment in chip production equipment is driven not only by its top-tier chip manufacturers but also by the increasing efforts of its small and medium-sized chipmakers, supported by government incentives to foster startups. China’s policy in this area mirrors its approach to EVs, with over 100 manufacturers now in the market. The U.S. still leads the technological race on semiconductors, but the Chinese are clearly trying to catch up (Canuto, 2023b).

Figure 4

The automotive transition is proving to be a complex and non-linear component of the broader energy transition. Were it not for the cost increase associated with protectionist policies, the toll on the road to decarbonization might be lower (Canuto, 2021). But that seems to be the price of rising geopolitical and technological rivalry, accompanied by risks of geoeconomic fragmentation (Canuto, 2023b).

References

Beattie, A. (2024). Why the US can’t impose its will over global trade in electric cars, Financial Times, October 3.

Bounds, A.; White, E.; and Inagaki, K. (2024). EU member states agree to impose tariffs on Chinese electric vehicles, Financial Times, October 4.

Canuto, O. (2007). Biofuels and Development: The Third Dividend, paper presented at the panel “The future of ethanol, biofuels, and energy policy in the Americas”, Americas Society and Council of the Americas, New York, February 22,

Canuto, O. (2020). Brazil, South Korea: Two Tales of Climbing an Income Ladder, Policy Center for the New South, PB-20/70, September.

Canuto, O. (2021). Decarbonization and “Greenflation”, Policy Center for the New South, PB-51/21, December.

Canuto, O. (2023a). A Tale of Two Technology Wars: Semiconductors and Clean Energy, Policy Center for the New South, PB-41/23, November.

Canuto, O. (2023b). Growth Implications of a Fractured Trading System, Policy Center for the New South, September 21.

Inagaki, K. (2024). European carmakers brace for a deeper and longer downturn, Financial Times, October 2.

This Post Has One Comment

very timely as europe debates tariffs on Chinese EVs

Comments are closed.