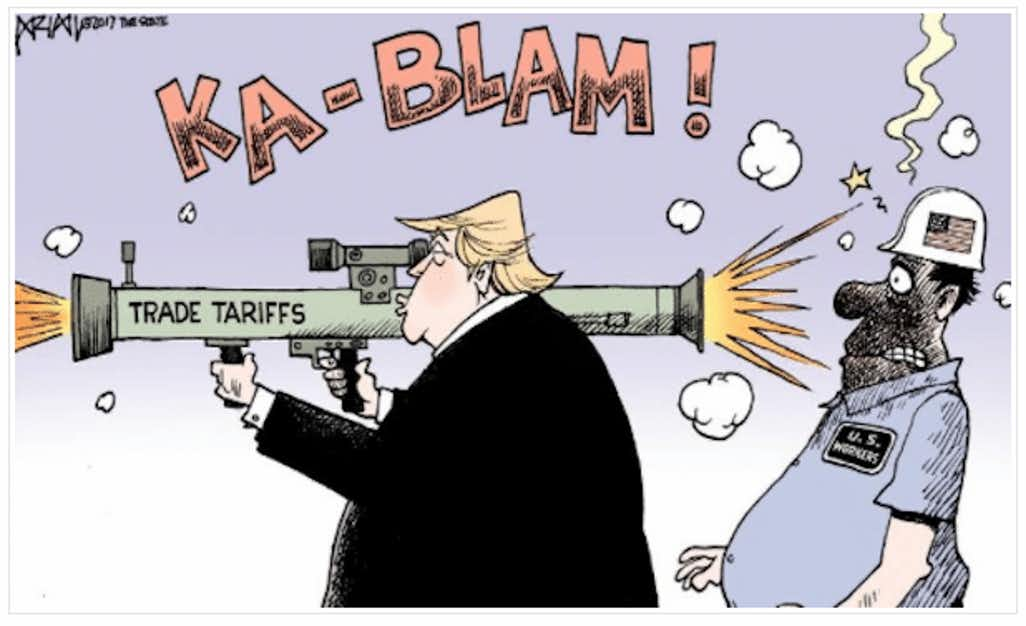

The global economic environment has changed as the U.S.—and to a less confrontational degree, the European Union—have clearly established a context of technological rivalry with China. Hindering China’s progress in the sophistication of semiconductor production has become a centerpiece of current U.S. foreign policy. While the U.S. is clearly winning the semiconductor war, the picture is different when it comes to clean-energy technology.

Both technology wars overlap with access to and refinement of critical raw materials (CRM), which are key upstream components of the corresponding value chains, encompassing mineral-rich emerging markets and developing economies. The way in which the U.S. and the European Union approach the goal of self-sufficiency, as well as access to and refinement of CRMs, will make a big difference to their stakes in the technology wars.