Financializing Commodity Markets: Consequences, Advantages and African Case Study

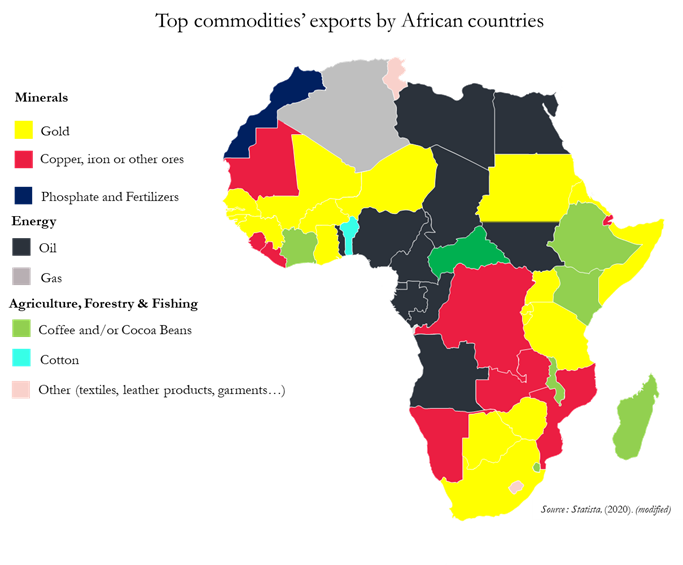

Africa has a wealth of natural resources, including minerals, agriculture, and energy commodities, which offers an opportunity to harness commodities’ financialization in the continent, a concept that has gained global attention, with debates surrounding its potential benefits and drawbacks. Although the financialization of commodities has been studied in various contexts, including in African countries, challenges such as liquidity constraints and market readiness have emerged as critical impediments to its widespread adoption. This paper examines the existing literature to clarify the positive and negative aspects of commodity financialization, drawing on global examples and specific cases within Africa. By examining best practices and lessons learned, the paper offers guidance on how African countries can navigate the complexities of preparing for and embracing commodity financialization to unlock its potential benefits while mitigating associated risks.