External Debt Management in Africa: A Proposal for a ‘Debt Relief for Climate Initiative’

T20

TF-1: Macroeconomics, Trade, and Livelihoods: Policy Coherence and International Coordination

Also: Policy Center for the New South; ORF

A decade of poor growth, increased poverty, and political instability followed the serious debt difficulties that emerged worldwide in the 1980s. There are concerns that the looming debt crisis could create similar challenges and result in even more severe consequences. However, the current economic climate differs in many ways from that of the 1980s, when international banks and Paris Club creditors held most of the external debt. Today, the profile of creditors is more diverse, and the mechanisms established by the G20 and multilateral development banks to address this new crisis are partly based on outdated approaches that are no longer effective in adapting to new realities.

As a result, a more holistic and integrated approach is required to address the challenges of external debt faced by developing countries, particularly in Africa. Such an approach should take into account the issue of over-indebtedness while also addressing climate protection, the most pressing issue of the 21st century. A promising solution to tackling these challenges could be a new debt reduction initiative focused on climate action. This policy brief recommends a ‘Debt Relief for Climate Initiative’ that will link debt reduction with investments in climate adaptation and mitigation projects.

- The Challenge

The history of debt in Africa is a long and painful one. It began in the 1980s, when the public finances of most developing countries deteriorated following the two oil shocks. A ‘lost decade’ of low growth, increased poverty, and political instability ensued. The recovery from the debt crisis only became possible following initiatives in favour of heavily indebted poor countries (HIPCs) and the work of the Multilateral Debt Relief Initiative. Thanks to these measures, the average debt-to-GDP ratio in Africa decreased from over 65.9 percent in 2000 to 32.6 percent in 2010, and the International Monetary Fund (IMF) estimated a debt reduction of nearly US$100 billion in Sub-Saharan Africa during this period.[1] This gave some breathing room to African countries to stabilise their financial situations and encourage development spending in the region.

In this context and given their greater fiscal space, African countries have allowed for some budgetary laxity, which has led to a reaccumulation of debt since 2011. This has also been furthered by a wider access to international financial markets in an environment of low interest rates. This accumulation has been more significant after 2013 and the commodity price shock. At the time, the economic situation caused cumulative currency depreciations, widened deficits, and a general deterioration of macroeconomic conditions in African countries in various ways. Indeed, between 2012 and 2017, real GDP growth in Africa fell from an average of 6.2 percent to 4 percent, while the average budget deficit increased from 2.1 percent of the GDP to 5.5 percent. As a result, over two-thirds of Sub-Saharan African countries have seen their public debt as a percentage of GDP increase by more than 10 percentage points, while a third of countries have experienced an increase in the debt-to-GDP ratio of more than 20 percentage points.[2]

The COVID-19 pandemic, which had a significant impact on the public finances of countries across the continent, has worsened the situation. In fact, the crisis pushed the gross financing needs as a percentage of GDP above the critical threshold of 15 percent for most countries, leading to an additional increase in debt levels of 10 percent to 15 percent. The average debt-to-GDP ratio has recently exceeded 70 percent.[3] The immediate needs for public health and stimulus spending, combined with the drastic reduction in tax revenues following the global economic slowdown, as well as a dip in the export revenues of resource-rich countries, have exerted an unbearable external pressure on the most vulnerable countries on the continent, which are now struggling to keep up with their interest payments. In 2020, debt service payments in more than 20 African countries represented over 14 percent of public revenues, and in five of these countries, this ratio was higher than 30 percent.[4]

These higher debt levels across Africa have begun to raise concerns about a return to unsustainable debt levels, especially given the limited ability of these countries to generate the necessary budgetary resources to keep up with the rapid increase in debt. Since 2016, the IMF and the World Bank have been sounding the alarm by stating that the debt levels of some African countries are approaching pre-HIPC ratios and that signs of a possible new debt crisis are becoming apparent. The source of these concerns is not only the rapid accumulation of debt, but also the changing structure of African debt and, in particular, the profile of creditors.

Africa does not have to deal with the same creditors as before. At the beginning of the 21st century, the bulk of Africa’s public debt was owed to multilateral institutions and some bilateral creditors of the Paris Club. Due to debt relief initiatives, these countries have been able to rebuild their debt capacity, which has given them better access to market-based debt instruments. As a result, about 19 African countries entered the Eurobond market, taking advantage of a prolonged period of low interest rates that followed.[5] Additionally, private investors, seeking alternatives to the low rates provided by developed countries, were attracted by the yield prospects offered by African sovereign bonds. This interest in commercial debt increased the share of private creditors from 20 percent in 2010 to more than 41.3 percent in 2020.[6]

Along with the proliferation of private creditors in Africa, the profile of bilateral creditors has also changed. The share of external debt held by bilateral lenders, mostly traditional Paris Club creditors, declined from 52 percent in 2000 to 10.3 percent between 2000 and 2020, while China has strengthened its position as the largest lender to Africa. China loaned about US$160 billion to African countries between 2000 and 2020, with the pace of lending accelerating since 2010, from an average of US$2.5 billion between 2000 and 2009 to about US$12.3 billion per year in the decade after.[7] In 2020, it was estimated that 17 percent of the total external debt of the Sub-Saharan region is owed to China.[8]

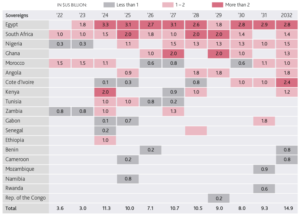

The increase in borrowing from non-Paris Club creditors and commercial lenders has resulted in shorter maturities and higher refinancing risks. There has been a significant rise since 2014 in the issuance of 10- and 15-year Eurobonds by many African countries. Additionally, non-Paris Club loans with shorter maturities than traditional long-term concessional multilateral loans has led to a concentration of sovereign debt maturities between 2024 and 2028 that need to be refinanced under tight international financial conditions, just as countries are recovering from the pandemic and are dealing with the new inflationary shock resulting from the war in Ukraine (see Figure 1). This concentration of maturities increases the risk of debt distress for some African countries, while others, such as Zambia and Ghana, have already announced payment defaults and requested restructuring under the common framework.

This shift in the creditor landscape presents other complex issues, particularly the challenge of negotiating debt restructuring. This is currently being observed within the Common Framework for Debt Treatment launched by the G20 in 2020. New creditors from emerging markets, such as China, India, and Saudi Arabia, have not historically participated in coordinated official creditor mechanisms, often preferring bilateral discussions, and current geopolitical divergences make this coordination even more challenging. Meanwhile, private creditors tend to be reluctant to offer debt reductions when they perceive that official creditors are slow to act.[9]

Figure 1: African sovereigns, Projected principal debt maturities (by year)

Source: Moody’s Investors Service.[10]

- The G20’s Role

The G20 plays a pivotal role in managing the external debt of developing countries, but it is facing numerous complex challenges. The mechanisms established to address this new crisis are partly shaped by approaches that have proven to be no longer effective in adapting to new realities. The Debt Service Suspension Initiative and the Common Framework have struggled to gain momentum, as evidenced by the handling of cases such as Zambia, Ethiopia, and Chad, which have requested restructurings. Discussions among stakeholders are challenging because supporters of multilateral development banks (MDBs) believe that these lenders should not suffer significant cuts, while bilateral creditors such as China feel it is unfair to ask them to bear all the sacrifices.[11]

Several debt relief initiatives have been successful in the past. However, these initiatives have often been preceded by tepid and unsuccessful efforts. Debt problems were often viewed as liquidity issues rather than solvency issues, which delayed solutions. In the era of multiple crises, it is crucial to adopt a holistic approach to resolving the challenges of external debt in developing countries.

Furthermore, the COVID-19 pandemic, geopolitical competition, the war in Ukraine, and stagflation have diverted international attention from development challenges and climate change. These issues can no longer be ignored, and it is essential for the G20 and MDBs to consider integrating them into the debt relief process for heavily-indebted countries. A new climate initiative for debt relief that takes into account the environmental challenges these countries face may be a promising way to address these challenges.

- Recommendations to the G20

The issue of public debt and climate change has emerged as a global concern. Historically, these two challenges have been addressed separately by the international community. Often, the countries most vulnerable to climate change are also those least equipped to cope with the crisis due to their high levels of indebtedness. Recent research has shown that some countries that are already heavily indebted or at a high risk of becoming so are also the most affected by climate change-related disasters.[12]

To tackle these issues in an integrated manner, we propose a new initiative called the ‘Debt Relief for Climate Initiative’ that seeks to link debt reduction with investments in climate adaptation and mitigation efforts. This proposal builds upon a similar model used in the past with the ‘Highly Indebted Poor Countries’ programme, which demonstrated that savings from debt reduction can be used to finance poverty reduction projects. However, in the case of the Debt Relief to Climate Initiative, the focus is on addressing climate change and preserving nature, which are the key priorities of the 21st century.

The proposed approach will involve partial debt relief for eligible countries in exchange for their commitment to investing the savings from debt service into climate-related projects, such as irrigation, food security, protecting cities from sea level rise, building cyclone resistant schools and hospitals, as well as mitigation projects such as renewable energy or forest protection in Africa. This approach presents mutual benefits, as it allows debtor countries to have more resources for national investments, while creditors indirectly benefit from the positive effects on the global public good that is the climate. Furthermore, this initiative could have additional benefits for debtor countries, such as improving their sovereign credit rating, and making public borrowing less costly.

Integrating debt reduction with climate investment in this initiative will assist in securing financing for climate adaptation and mitigation in developing countries, specifically in Africa. Africa is projected to require US$2.8 trillion between now and 2030 to meet its nationally determined contributions as per the Paris Agreement.[13] According to a study conducted by the International Institute for Environment and Development , there are 58 countries worldwide that are either heavily indebted or at a high risk of debt distress that could benefit from a climate and nature-linked debt initiative. Researchers estimated that immediate debt relief could unlock up to US$105 billion for climate change and biodiversity loss projects, surpassing the climate financing promised in the form of grants in 2019, which amounted to US$17 billion.[14]

Conditions

The proposed programme for relieving debt should adhere to the following principles:

- The programme must be preferable to or at least equivalent to the current status quo, as perceived by all parties involved. Otherwise, there will be no motivation for stakeholders to agree to it.

- No participant should be allowed to benefit without making a contribution. All creditors must participate in the programme, or else it should not be implemented. If a creditor refuses to cooperate, the programme should allow the debtor country to default on that creditor’s debt by utilising the ‘loan in arrears’ policy.

- It should grant debtor countries enough flexibility to carry out sustainable, long-term investment projects that can tackle the impacts of climate change.

Implementation

To ensure the success of the initiative, several key considerations need to be taken into account. Firstly, it is important to clearly define which projects are eligible for debt relief and how they will be selected. It is crucial that these projects are genuinely climate-related and contribute to the goals of the Paris Agreement. This will require close collaboration between borrowers, creditors, and development partners to identify and prioritizse the most urgent needs for climate adaptation and mitigation.

Secondly, a robust monitoring and evaluation system is needed to ensure that the savings from debt relief are effectively channeled towards the agreed-upon climate projects. Independent observers such as the World Bank can conduct an annual review of the financial situation and material implementation of the project. However, it is necessary to ensure that governments’ contributions to these projects are in line with their capacities to generate revenues, and ensure proper monitoring.

Thirdly, it is essential to establish a clear mechanism for dealing with private creditors, as their participation in the initiative may not be straightforward. The same is true for the case of China, which is the largest bilateral creditor of several African countries. Debt and equity swaps could be used to convert debt into concrete climate transition investment projects. However, the use of equity may not be appropriate for all adaptation projects that are purely public projects, which will need to be taken into account.

One alternative proposed to address this category of creditors is for MDBs and G20 countries to help the heavily indebted countries explore the issuance of their own “Brady bonds” with lower interest rates and longer maturities to repurchase a significant portion of their debt. In the past, this type of Brady restructuring usually included at least two types of bonds, Par Bonds and Discount Bonds. Par Bonds were issued to the same value of the original loan with coupons on the bonds set below the market rate of interest, allowing for debt service reduction over the term of the bond. Discount Bonds were issued at a discount to the original value of the loan (generally a 30-50% discount), allowing for immediate debt reduction. These bonds carried a market-based floating rate of interest. The principal of both Par and Discount bonds was secured by a series of zero-coupon U.S. Treasury bonds (or zero-coupon World Bank bonds) with the same date of maturity as the newly issued bonds. The indebted countries involved in this restructuring used the proceeds from loans and credits from the multilateral development banks to purchase these zero-coupon bonds. This approach offers advantages such as increased assurance of debt collectability, greater tradability of the restructured debt, and linking debt relief to economic reforms, ensuring effective utilization of funds for sustainable development.

In conclusion, the Debt Relief for Climate Initiative is a proposed solution to the interlinked challenges of public debt and climate change in developing countries, particularly in Africa. By linking debt reduction to investments in climate adaptation and mitigation efforts, this initiative offers mutual benefits for debtor and creditor countries, as well as for the global public good that is the climate. The success of the initiative will depend on the clear definition of eligible projects, the establishment of a robust monitoring system and the participation of all creditors. Indeed, the Chinese have complained in the current negotiations that they are being asked to take haircuts when the MDBs’ debts are protected. As in the case of HIPICS, the MDBs should participate in the debt reduction effort. This should put China in a position where it is politically difficult (given its relationship with Africa) to refuse to participate. The potential benefits of immediate debt relief for climate and nature projects are considerable, and this proposal is a promising way forward to tackle the critical issues of the 21st century.

Attribution: Otaviano Canuto et al., “External Debt Management in Africa: A Proposal for a ‘Debt Relief for Climate Initiative’,” T20 Policy Brief, June 2023.

Endnotes

[1] International Monetary Fund, Heavily Indebted Poor Countries (HIPC) Initiative and Multilateral Debt Relief Initiative (MDRI)—Statistical Update, IMF, September 2019.

[2] World Bank, Africa’s Pulse, No. 17, April 2018.,Washington, DC: World Bank, 2018.

[3] African Development Bank, African Economic Outlook 2021, From Debt Resolution to Growth: The Road Ahead for Africa, March 2021.

[4] Organisation for Economic Co-operation and Development, African Union Commission, and the African Tax Administration Forum, Revenue Statistics in Africa 2021, OECD, AUC and ATAF, Paris, 2021.

[5] Hinh T. Dinh, “COVID-19 & Developing Countries—the Road to Recovery,” Policy Centre for the New South, 2022.

[6] Ishac Diwan, “China’s Developing Countries Debt Problem,” Finance for Development Lab, December 2, 2022.

[7] “Chinese Loans to Africa Database,” Global Development Policy Centre.

[8] Diwan, “China’s Developing Countries Debt Problem”

[9] Reza Baqir, Ishac Diwan, and Dani Rodrik, “A framework to evaluate economic adjustment cum-debt restructuring packages,” Finance for Development Lab, Working Paper 2, January 2023.

[10] “Sovereigns – Africa: Rollover Risk Increases amid Tighter Financial Conditions and Upcoming Maturity Wall,” Moody’s Investors Service, June 28, 2022.

[11] “Sovereigns – Africa: Rollover Risk Increases”

[12] Marcos Chamon, Klok Erik, Thakoor Vimal, and Jeromin Zettlemeyer, “Debt-For-Climate Swaps: Analysis, Design, and Implementation,” IMF Working Paper, WP/22/162, August 12, 2022.

[13] Kulé Galma, “Here’s How African Leaders Can Close the Climate Finance Gap,” WeForum, November 15, 2022.

[14] Sejal Patel, “Averting the Crises How a New Approach to Debt Could Raise US$400 Billion for Climate and Nature,” International Institute for Environment and Development, July 2022.

https://t20ind.org/research/external-debt-management-in-africa/