Qual será o formato da recuperação econômica pós-coronavírus?

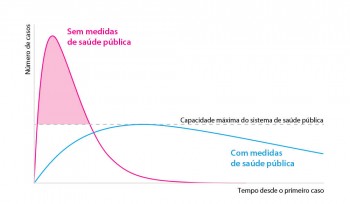

As projeções macroeconômicas divulgadas pelo Fundo Monetário Internacional (FMI) em abril mostraram uma economia global derrubada pela Covid-19. Noventa países deverão ter seus PIBs encolhidos este ano. Mesmo se antecipando um retorno a taxas positivas de crescimento no próximo ano, a renda per capita no final de 2021 ainda será menor que a de dezembro do ano passado. Trata-se de um desastre econômico comparável ao que aconteceu durante a Grande Depressão dos anos 30 no século passado. Presume-se que a recuperação pós-crise deverá se iniciar na segunda metade do ano, pelo menos naqueles países onde o surto de coronavírus seja considerado como passado e as políticas de achatamento da curva pandêmica possam ser relaxadas. Os choques provocados pela Covid-19 têm sido profundos enquanto duram, mas invariavelmente serão temporários. Quão rápida será tal recuperação, ou seja, qual será o formato da curva de evolução do PIB no tempo? De que dependerá esse formato?