Otaviano Canuto

Global financial integration and the linkages between the financial and the real sides of economies are sources of huge policy challenges. This is now beyond doubt, after what we saw in the run-up to and the unfolding of the 2008 global financial crisis. As a consequence, the established wisdom regarding monetary policies and prudential regulation has been subject to a deep critical review, including a demise of the belief that they should be maintained as fully independent functions.

The issue is particularly relevant in the case of emerging markets (EMs), where those policy challenges associated with macro-financial linkages are even greater than in advanced economies (ACs). At the same time, the circumstances of the post-2008 global financial setting have forced emerging markets to navigate through uncharted territories, by combining monetary policies and prudential regulation in ways about which there is still a gap of missing knowledge and cumulative experiences.*

Asset price dynamics matters, especially for emerging markets

Asset prices and leverage by financial institutions are at the center of the interaction between finance and the real economy, and the main conduit through which booms and busts are generated or amplified. Banks and other financial intermediaries can easily extend their balance sheets when asset prices are rising, further fueling asset price booms, with a corresponding feedback loop on those balance sheets. Banks resort to funding with non-core liabilities — different from those on which banks draw during normal times, such as retail deposits by households — increasing exposure to balance-sheet weaknesses or mismatches on liquidity, maturity, and/or foreign exchange (Hyun Song Shin).

Systemic risks are also cross-sectional, arising from the growing interconnectedness of financial institutions and markets during booms (Viral V. Acharya). Financial innovation, growth of non-regulated “shadow banking” activities, and complex chains of financial intermediation facilitate the build-up of an increasingly vulnerable pyramid of assets-liabilities. This can potentially drag down the real-side economy once that pyramid starts to crumble.

“Emerging market economies have to cope with even greater challenges when it comes to managing the implications of macro-financial linkages.”

One may think that these challenges are the domain of advanced economies and their sophisticated financial systems. After all, that is where the recent global financial boom-bust originated. Think twice. As shown by Claessens and Ghosh, emerging market economies (EMs) have to cope with even greater challenges when it comes to managing the implications of macro-financial linkages, particularly due to their propensity to heighten booms and busts.

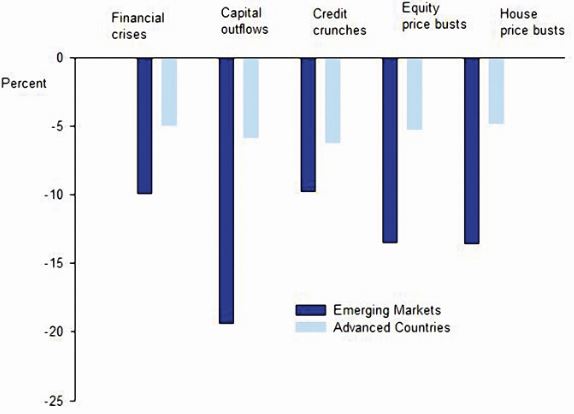

Chart 1 – Cumulative Output Losses Associated with Different Adverse Financial Events.

Source: Canuto and Ghosh, based upon Claessens and Ghosh

This is due to two reasons. First, EMs are more likely to suffer shocks, such as commodity-price and terms-of-trade shocks, as well as surges and sudden stops in capital flows. It is not only a matter of frequency, but also of magnitude relative to domestic economies and the size and depth of their financial markets. As Swati and I remark:

“On average, total net private capital flows relative to M2 [a measure of the quantity of money in an economy] over 2000-10 has been some factor 100 times that for advanced countries (ACs). As a share of local capital markets, financial flows in EMs are thus much larger than in ACs, and certainly more volatile. Also foreign bank presence is greater — more than double — in EMs than in ACs. Unsurprisingly, therefore, shocks to capital flows and foreign banks’ operations can have significant impacts on EMs’ domestic financial and real sectors. Perhaps more importantly, the amplification of shocks tends to be larger in EMs.”

Second, structural and institutional features typical of most EMs tend to amplify and propagate shocks. Despite substantial progress since the 1990s, the overall quality of regulatory institutions, the strength and enforceability of legal regimes, market discipline upon financial institutions, levels of information disclosure and transparency, corporate governance arrangements, the width of investor bases, the availability of hedging instruments, and other financial-sector supporting factors still have room to grow. In such a context, investor confidence is prone to fluctuate more violently before and after shocks.

Claessens and Ghosh identify capital inflows and their potential for sudden stops as main sources of risk and shock for emerging markets. They also empirically show that the interaction of real and financial cycles tends to be sharper in EMs than in advanced economies, with both recessions and recoveries more often overlapping with financial events. Furthermore, the real-side impact is much larger. From1960 to 2012, cumulative GDP losses associated with different adverse financial events were typically higher in EMs (Chart 1). Even when asset price-led cycles are not generated within EMs, they tend to be affected the most due to capital flows.

Should monetary policy react to asset prices?

Before the crisis, the policy paradigm used to look like this: central banks around the world would focus on inflation-targeting and on setting interest rates, while financial regulation would be left to specialized, ad hoc agencies. Central banks’ primary role would be enough to maintain price stability and economic growth. On their side, financial regulators, through prudential rules, would ensure the soundness of financial institutions and protect depositors.

Asset price cycles had been a concern for many years but were seen as a separate issue that was not a monetary policy concern. Even when the frequent appearance of asset price bubbles started to be acknowledged, the belief was – “the Greenspan-Bernanke approach” (Greenspan (2002) and Bernanke (2002)) – that attempts to detect and prick them at an early stage would be impossible and potentially harmful. If necessary, mopping up after the burst of a bubble through interest rate cuts to help economic recovery would be safer.

Low and stable inflation was considered to be a necessary and sufficient condition for stable growth with moderate unemployment. It could be pursued, inter alia, through an inflation targeting framework, using interest rates and clear communication rules to achieve a pre-defined inflation objective, as the single focus for monetary authorities. Stable inflation would also result in low risk premiums, which together with competition and prudential rules in financial markets would help to achieve financial stability. The “Great Moderation” in developed economies, with relatively low inflation rates and small output fluctuations from the mid-80s onward, seemed to vindicate that confidence.

As we now know, this world of presumed stable monetary and financial conditions was severely shaken by the global financial crisis. With the benefit of hindsight it is easy to draw lessons. Asset price booms and busts were acknowledged to be both pervasive and harmful: real estate and stock-market booms contributed to excess US household debt and to fragile asset-liability structures; the interconnectedness of financial firms’ balance sheets, and the danger of too-big-to-fail institutions. The rapid global transmission of an asset price bust pushed the world economy to the edge of quasi-collapse (Canuto, 2009). Definitely, monetary policy makers can no longer neglect – or belittle – the dynamics of asset prices.

But was it lax monetary policy that led to the creation of such bubbles and then to financial instability? Some say yes (Taylor, (2009)); others say no. For Svensson (2010), for example, the financial crisis was caused by factors other than monetary policy; monetary policy and financial-stability policy are distinct–it was the latter that failed.

But if financial stability is indeed a legitimate concern for a central bank, then should we integrate a “financial variable” (e.g., an asset price indicator) into the monetary policy framework? More specifically, should policymakers incorporate indicators of financial stability into the central bank’s reaction function? Should they react automatically to variations in asset prices – or some associated variable, such as credit expansion – as they do under inflation targeting regimes in the case of variations in output gaps and inflation?

The emerging consensus seems to be that credit-fueled bubbles (e.g., real estate) should be differentiated from equity-type bubbles. While the former frequently carry with them the seeds of systemic crises, the latter often undergo a more bounded process of correction and price adjustment. Blinder (2010), for instance, argues that “a distinction should be drawn between credit-fueled bubbles (such as the house price bubble) and equity-type bubbles in which credit plays only a minor role (such as the tech stock bubble)”. In this view, the “mop-up-afterwards” approach is still appropriate for equity bubbles not fueled by borrowing, but the central bank should try to limit credit-based bubbles—though probably more with regulatory instruments than with interest rates. This attitude may eventually become the new consensus on how to deal with asset-price bubbles; indeed, Bernanke (2010) comes close to endorsing it.

On the other hand, in any case it is often recommended not to treat asset prices on the same footing as the other components of monetary-policy decision rules, like output gaps and expected inflation of goods and services. After all,

“(…)even the best leading indicators of asset price busts are imperfect – in the process of trying to reduce the probability of a dangerous bust, central banks may raise costly false alarms. Also, rigid reactions to indicators and inflexible use of policy tools will likely lead to policy mistakes. Discretion is required (our emphasis)” (IMF, 2009:116).

How to implement monetary policy and prudential regulation in a complementary way?

Neglect of asset prices by monetary-policy makers was not the only established practice to be over-ruled. Prior to the global financial crisis, financial stability was taken for granted provided that individual financial institutions adopted sound prudential rules, maintaining adequate levels of capital commensurate with types and levels of risks they faced. In that context, the responsibility for such prudential regulation was left independent and isolated from monetary policy making.

The crisis has shattered this view. Prudential tools concerned with ensuring the soundness of individual institutions and the protection of depositors have not sufficed for financial stability and the avoidance of financial crises. Sound risk management of individual financial institutions is not enough to guarantee sound management of system-wide risk.

Why? Despite well-designed prudential rules at the level of individual institutions, there might be spillovers and externalities across institutions that affect the financial system as a whole (e.g., bank panics, fire-sale of assets and credit crunches). Either because of inter-linkages among balance sheets of financial institutions and/or of contagion in terms of confidence, risks taken by single financial institutions may end up affecting the entire financial system.

That might come, for example, from the system’s characteristics: a financial system composed of large, interconnected firms is likely to produce moral hazard in the face of the (now) standard too-big-to-fail dilemma for policy-makers. Even if all firms are soundly regulated, the possibility of one failure in this inter-connected system creates contagion and negative externalities to the whole system. But this can also happen in a very different context, say in a system composed of small, and independent, perfectly regulated and unconnected financial firms. It suffices that all firms use the same identical risk-assessment model that might be flawed by not considering a specific tail event. If this event materializes, the whole system could collapse, regardless of its apparent robustness and lack of connectedness.

Other examples of why institution-level prudential tools are insufficient can be found in the mortgage industry. Despite a number of consumer protection rules to limit over-borrowing and guidelines for the industry to scrutinize a borrower’s willingness and ability to pay, the extension of mass lending for real estate has been an almost universal feature of credit booms in all countries.

Asset-price cycles – and the corresponding likelihood of full-blown financial crises – may well establish a feedback loop with pro-cyclical risk assessments present in traditional prudential rules. Suppose, for example, that there is a widespread increase in house prices, due to a demand shock. The rise in the value of real estate as collateral tends to raise the repayment probability for housing loans, which reduces the lending rate charged by credit suppliers. Additionally, if financial institutions follow their own assessment of risks when estimating appropriate ratios between capital and risk-weighted assets to be held, capital costs associated with such credits decline. Reduced borrowing costs stimulate borrowing for investment purposes in the economy at large, most likely leading to further bouts of house price hikes. If house price bubbles develop, there will be a whole network of larger interlinked balance sheets, dependent on overvalued collateral, although individually balance sheets (including those of individual home owners) may look sound.

Therefore, there is a need for a macroprudential regulation (concerned with ensuring the stability of the financial system as a whole and the mitigation of risks to the real economy). Macroprudential regulation aims to make the overall incentive structure for financial firms coherent and consistent so that the above mentioned externalities are internalized by the system. The idea is to design a set of principles and rules that can reduce each institution’s contribution to systemic risk and that smooth the financial cycle (i.e., reducing the systemic risk that inherently builds up in booms and has damaging consequences in slumps since leverage, risk-taking, credit and asset prices are pro-cyclical and crises typically follow booms).

In fact, prudential regulation and monetary policy are now seen as complementary. Neither one can replace the other on its own. The combined use of both tends to be more effective than a standalone implementation of either. After all, financial risks are now seen as important enough for macroeconomic management to deserve a stronger regulation going beyond that of specialized agencies. If an economy is to pursue macroeconomic and financial stability, monetary policy makers should at least coordinate with financial supervisors to ensure financial regulation and monetary policies are consistent, and implemented in an articulated way.

Reflecting the two distinctive types of macrofinancial risks illustrated above, macroprudential instruments can either assume a time series or a cross-section dimension. When systemic behavior over time is considered, the key issue is how risks can be amplified by interactions within the financial system and between the financial system and the real economy. On the other hand, the cross-section dimension relates to the common exposure of institutions at each point in time. Correlated assets, or even counterparty interrelations, create such a link among financial institutions.

In the time series dimension of macroprudential issues, monetary policy and macroprudential tools can clearly be complementary in reducing pro-cyclicality. However, the scope for joint calibration may be less obvious in the case of cross-sectional macroprudential regulation, in which the calibration must be conducted using a top down approach.

A rule of thumb for integrating monetary policy and macroprudential regulation may be to retain some division of labor, even if a more direct combination is considered the best way to go. Fine-tuning via monetary policy should be favored when stability issues are of a homogeneous and reversible nature. Moreover, macroprudential instruments tend to be more demanding in terms of implementation lags and transaction costs to financial institutions, whereas movements in short-term interest rates are faster, simpler to carry out and easier to communicate to the general public.

Emerging markets and other capital-receiving economies face an additional challenge: compared to purely domestic asset price cycles, do cross-border capital flows and the potential transmission of asset price booms and busts impose additional layers of complexity? The answer is yes based on overwhelming evidence. Not by cance, as already mentioned, capital inflows and their potential for sudden stops are clearly main sources of risk and shock for emerging markets.

Capital flow management policies can be an item for regulators to use in their toolkit when looking to address macroeconomic and financial instability risks. This is particularly the case in economies subject to significant spillovers from asset price cycles and policies from abroad, and in which the macroprudential and monetary policies are insufficient to ring-fence the economy. However, given the short life and usually low effectiveness of capital controls, more conventional policies should be explored first before considering this remedy.

Brazil, Korea: Two Tales of a Macroprudential Regulation

Let’s summarize up to here. The pervasiveness and relevance of asset price booms and busts in modern economies has now been fully acknowledged. The case for combining prudential regulation and monetary policy in a complementary pursuit of financial and macroeconomic stability, rather than their use in isolation, is now firmly grounded. This is a key issue particularly for policy makers in emerging markets, where the interaction of real and financial cycles tends to be sharper than in advanced economies, with both recessions and recoveries more often overlapping with financial events and much larger real-side impacts.

The devil is in the details, however. As we illustrated in the previous items, there are still serious questions on how to proceed with the complementary use of prudential regulation and monetary policy. While there are already lessons from emerging markets’ use of the macroprudential toolkit, more experience and analysis, particularly on its interaction with monetary policy is needed.

To this point, recent experiences of Brazil and Korea, as reported in two chapters of a newly released book – Canuto and Ghosh (2013) – help fill that gap. They offer complementary examples of the learning-as-you-go process, by which the various components of macroprudential regulation are put in place. This contrasts with the advanced stage of policymaking and blueprints that have been attained on the monetary-policy front.

Furthermore, those country experiences also illustrate how both time-series and cross-section dimensions of macrofinancial risks must be on the radar of policy makers. Brazil and Korea present seemingly opposite but complementary examples of the relevance of taking both dimensions into account.

Consider that after the 2008 global financial crisis, Brazilian policy makers deployed macroprudential policies in articulation with monetary policy when jointly pursuing anti-inflation and financial stability objectives. The economy had over-rebounded and started to exhibit signs of overheating in 2010 as a result of fiscal and monetary policies implemented after the global shock. Global liquidity, high commodity prices and strong capital inflows further fueled aggregate demand expansion through domestic credit – which had been rising already at high rates since 2005. It was clearly an opportunity when monetary and prudential instruments could appropriately be combined in unidirectional retrenching, avoiding simultaneous build-up of both inflation and financial fragility. After all, any use of either monetary or prudential policies on their own under those circumstances might have led to contradictory and self-defeating impacts on those two objectives: simply hiking interest rates would attract more capital inflows; and restraining credit supply with no policy interest rate increase would lead to channeling demand for credit to other intermediation vehicles.

Instead there was a combination of policy interest rate hikes and an announced fiscal tightening along with several macroprudential policies. These included: higher bank reserve requirements to curb the transmission of excessive global liquidity to domestic credit markets; stronger terms for specific segments of the credit market to stem the deterioration in the quality of loan origination; reserve requirements on banks’ short spot foreign exchange positions; and taxes applied to specific types of capital inflows to correct imbalances in the foreign exchange market and to dampen intensified, volatile inflows of capital.

Those measures succeeded in slowing the growth of household credit to a more sustainable pace. Nevertheless, partly as a consequence of a second dip of the global financial crisis associated with political and policy stalemates in the US and the Euro zone – Canuto (2013) – and partly because of domestic developments, Brazilian policy-makers were pushed to not only suddenly reverse its monetary-policy stance in 2011, but also felt the need to rapidly fine-tune its macroprudential toolkit, given the unevenness of results. Reflecting on this time, Pereira da Silva and Harris (2013) note that:

“Most of the macro prudential measures applied in Brazil since 2010 related to the time dimension of systemic risk, in other words to “leaning against the wind” and dealing with the cyclicality of the financial system. However, experience gained from the 2008 crisis has illustrated that, as the financial system becomes more complex and sophisticated, risks can arise not only in a single sector but also as an interlinked, system-wide issue. In fact, the Brazilian financial system is characterized by a high degree of conglomeration and concentration. (…) Therefore, another challenge is to develop effective indicators and to monitor cross sectional risks related to the interconnectedness of the financial system and the real economy.”

Korea in turn, had acquired some experience with several macroprudential policy instruments much prior to the 2008 global financial crisis. Liquidity ratio regulations had long been in place in response to the 1997 financial crisis. Furthermore, as signals of euphoria in the housing market became clear in the 2000s, loan-to-value and debt-to-income control ratios were also enacted. But unlike Brazil, Korea lacked specific measures aimed at the time-series risk dimension. This left loopholes for banks to raise excessive leverage through funding with “non-core liabilities” – i.e. instruments banks would not draw on during normal times, such as retail deposits by households – leading to a round of crisis-like events in 2008. As Jong Kyu Lee (2013)points out regarding the focus of Korea’s regulation on ratios:

“(…) a liquidity ratio is unable to fully and flexibly reflect all aspects of structural changes in the related financial markets, and cannot prevent accumulation of financial imbalance. Reliance on a few ratios, (…) even though applied from the [macroprudential policy] perspective is not sufficient for securing financial stability.”

Let me highlight three of many lessons stemming from Brazil’s and Korea’s recent experiences.

First, while some division of labor between monetary policy and macroprudential regulation may be maintained in their combined application as suggested in the previous item, policy-makers need to make sure that prudential policies are mutually consistent and comprehensive enough to avoid regulatory arbitrage and exploration of loopholes. Second, a balance must be struck between the need for policies to be ahead of the curve, and the fact that learning-as-you-go is unavoidable.

Finally, communication by policy makers becomes trickier as they move from the clarity of rule-based monetary policy to its combination with macroprudential regulation. In the case of Brazil, for example, markets required an extraordinary effort from the Central Bank to clarify that macroprudential regulations were being implemented as a complement – rather than a substitute – to monetary policy.

Walking on the wild side

The global financial crisis has obliged policy-makers to leave the comfort zone previously established, one in which monetary policy making and prudential regulation tended to be seen as purely rule-based and isolated. Now not only a higher degree of discretion is acknowledged as inevitable, but also a complex articulation of the two sides is seen as necessary. Furthermore, given the dearth of available benchmarks and empirical references, a learning-as-you-go groping process cannot be avoided. What an unconventional territory for policy makers to cross, as compared to the pre-crisis orthodoxy…

First appeared at Capital Finance International