Financial Times, December 9, 2015

DECEMBER 9, 2015 by: Otaviano Canuto and Cornelius Fleischhaker

Brazil is undergoing its most severe recession in decades, with GDP expected to contract more than 3 per cent this year. Policy adjustments and the fallout from the Petrobras corruption scandal have eroded confidence and resulted in a collapse of investment, while the deterioration of fiscal accounts in the last few years has cost the country its investment grade rating. Not surprisingly, the Brazilian real has depreciated dramatically over the past year, losing about half of its value against the US dollar.

However, amid all the gloom, the depreciation of the real also provides a silver lining, as it is supporting the recovery of the trade balance and stimulating growth through increased net exports. Much of this positive effect has so far been overshadowed by weak commodity prices. However, when looking at quantities, an adjustment is clearly under way which should help Brazil restore its external balance.

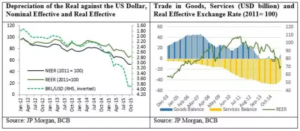

Since mid-2014, the real has depreciated 43 per cent against the dollar. Given the simultaneous depreciation of other currencies the real’s trade weighted (nominal effective) depreciation is less pronounced and the adjustment is even smaller when controlling for Brazil’s relatively high inflation. Yet even in real effective terms, the real has depreciated 27 per cent since mid-2014, restoring a level of competitiveness last seen in 2005.

A real depreciation has a positive impact for net exports and the current account balance. As imports become expensive and domestic prices of exportable goods rise, imports decrease and exports grow. Indeed, Brazil’s trade balance has begun to reverse years of deterioration, with goods trade recording a surplus for the first time since 2013 and the deficit in services shrinking.

The depreciation and weak domestic demand have already resulted in significant import compression. Goods imports fell by 21 per cent over the 12 months to October compared with the previous year. This collapse is not just due to the exchange rate effect, but also to weak demand, especially for capital goods and consumer durables in the current recession. Most of the decline in imports consists of a reduction of import quantities, of 14 per cent. However, lower prices of oil and other commodities also played a role. Services imports, mostly travel and professional services, have also declined by 14 per cent.

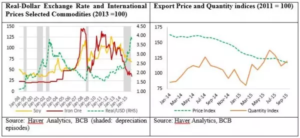

The positive effect on exports has been overshadowed by low commodity prices. While previous episodes of rapid depreciation of Brazil’s currency (1999, 2002, and 2008) were followed by a recovery or at least stability in the price of Brazil’s main export commodities, the current episode takes place in an environment of continued low commodity prices. The international prices of iron ore and soy beans, Brazil’s most important exports, are down 52 and 30 per cent respectively compared with the first half of 2014.

Commodities make up over half of Brazil’s goods exports, and their value in US dollar terms has fallen by 17 per cent over the past year. Yet adjusted for price changes, export quantities actually increased by 3.4 per cent in the third quarter of 2015 compared with the same quarter last year. Given the lagged effect of real depreciation on exports, especially of manufactures, we can expect export volumes to grow further, providing a much needed impulse to growth.

In summary, the drastic depreciation of the real provides a silver lining in Brazil’s current slump. By undoing years of real appreciation it helps to restore external balance. This is indeed a painful process as much of the adjustment comes in the form of reduced investment and consumption. The correction so far appears limited because it is hindered by adverse price movements. However, changes in quantities and lagged effects of the exchange rate on exports provide optimism for further improvements in the trade balance and a much-needed impulse for growth.

Otaviano Canuto is an executive director at the International Monetary Fund. All opinions expressed here are his own and do not represent those of the IMF or of those governments he represents at the IMF Board. Cornelius Fleischhaker is a PhD candidate at the Johns Hopkins University School of Advanced International Studies, focusing on economic policy in Brazil.